Updated: 04-11-2025

-

up to 3 000 000 000 UZSloan amount

-

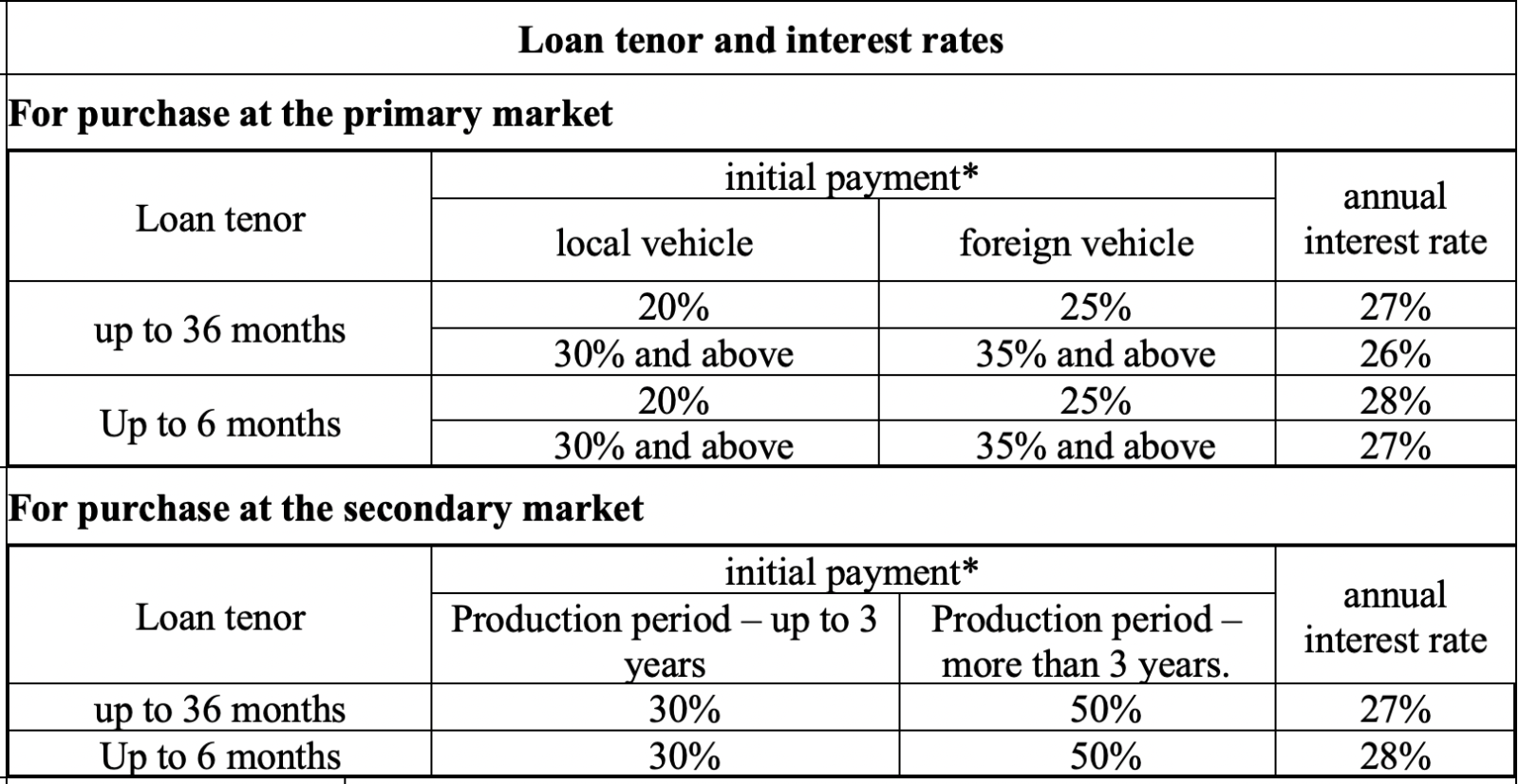

from 26%interest rate

-

up to 60 monthsloan term

| Parameter | Cost/Description |

| Purpose of the loan | Car loans for cars and trucks for up to 5 years in the primary and secondary markets. |

| Segmentation of customers | All types of legal entities and individual entrepreneurs |

| Requirements for credit history | 1. No overdue debt; 2. Positive credit history (score by the Loan Information and Analytical Center is above 200 points); 3. No existing loans categorized as "unsatisfactory", "doubtful" or "bad". |

| Loan amount | Up to UZS 3,000,000,000 (three billion) |

| Loan tenor | Up to 60 (sixty) months |

| Grace period | up to 6 (six) months |

| Currency of loan | National currency (UZS) |

| Form of the loan | By transferring the monetary means to the dealer's account or the seller's car dealership, or to the sellers' accounts in case of secondary market |

| Accrual of interest | Interest is accrued daily at a fixed rate and shall be repaid in the form of an annuity/differential as per an established schedule. |

| Loan repayment period | Payment of principal and interest – monthly; |

| The main requirements for the customer when a loan is granted | - Primary or secondary account opened in the system of "Garant Bank" JSC; - No negative credit history; - Profit and loss statement (Form No. 2) shall not be in the red for the last reporting period (annual or quarterly) (not applicable to the individual entrepreneurs, and newly established legal entities – within last 6 months); - Availability of positive own working capital (not applicable to the individual entrepreneurs, and newly established legal entities); - No arrears recorded in the register No. 2; - The debtor shall not be payable due to litigation initiated by the Bureau of Enforcement. |

| Forms of collateral | 1. Deposit funds; 2. Real estate; 3. Vehicles manufactured within last 5 years; 4. Vehicle purchased under the loan is secured by collateral, with execution of an insurance policy for the remainder of the collateral against the risk of the loan non-repayment. In this case, an insurance policy shall be executed against the risk of the loan non-repayment with due notarization before supply of the vehicle by the supplier. Collateral shall be at least 125% of the loan amount. - For persons affiliated with the bank, the loan deposit shall be 130%. * Pledge of the liquid assets may be accepted as collateral, if initial payment is not available. In this case, the interest rate on the loan shall be equal to the maximum interest rate established in the passport for this loan product. |

The list of documents required to obtain a loan

1. Application;

2. The constituent documents of the borrower company (certificate, charter, executive order and copies of the passports of the founders, director, accountant (if any);

3. Consent of the founders of the borrower company to receive a loan, executed in accordance with the procedure prescribed by effective law (not applicable to individual entrepreneurs and private companies);

4. Accounting balance sheet and profit and loss statement of the borrowing company (as submitted electronically to the relevant State Tax Authority) for the last reporting period (annual or quarterly) (not applicable to individual entrepreneurs and newly established legal entities);

5. Copy of the vehicle purchase and sale agreement;

6. Vehicle evaluation report (in case of procurement at the secondary market);

7. Report on the collateral evaluation conducted by an independent appraiser (if the collateral provided in the form of property but not the deposit funds).

2. The constituent documents of the borrower company (certificate, charter, executive order and copies of the passports of the founders, director, accountant (if any);

3. Consent of the founders of the borrower company to receive a loan, executed in accordance with the procedure prescribed by effective law (not applicable to individual entrepreneurs and private companies);

4. Accounting balance sheet and profit and loss statement of the borrowing company (as submitted electronically to the relevant State Tax Authority) for the last reporting period (annual or quarterly) (not applicable to individual entrepreneurs and newly established legal entities);

5. Copy of the vehicle purchase and sale agreement;

6. Vehicle evaluation report (in case of procurement at the secondary market);

7. Report on the collateral evaluation conducted by an independent appraiser (if the collateral provided in the form of property but not the deposit funds).

beta-версия