Updated: 08-11-2025

-

up to 1 000 000 000 soumsloan amount

-

from 0,0%interest rate

-

up to 60 monthsloan term

| Indicator | Value / Description |

| Purpose of the Loan | Auto loan for the purchase of Changan vehicles (models CS55 PLUS, UNI-K, UNI-T, UNI-V, and others) on the primary market. |

| Customer Segmentation | Legal entities and individual entrepreneurs. |

| Credit History Requirements | 1. No overdue debts; 2. Good credit history, with a credit score exceeding 200 points according to the Credit Information Analytical Center (KIAC) of the Central Bank of Uzbekistan; 3. No credit arrears exceeding 90 days within the last 6 months; 4. No active loans classified as “unsatisfactory,” “doubtful,” or “hopeless.” |

| Loan Amount | Up to UZS 1,000,000,000 (one billion soums). |

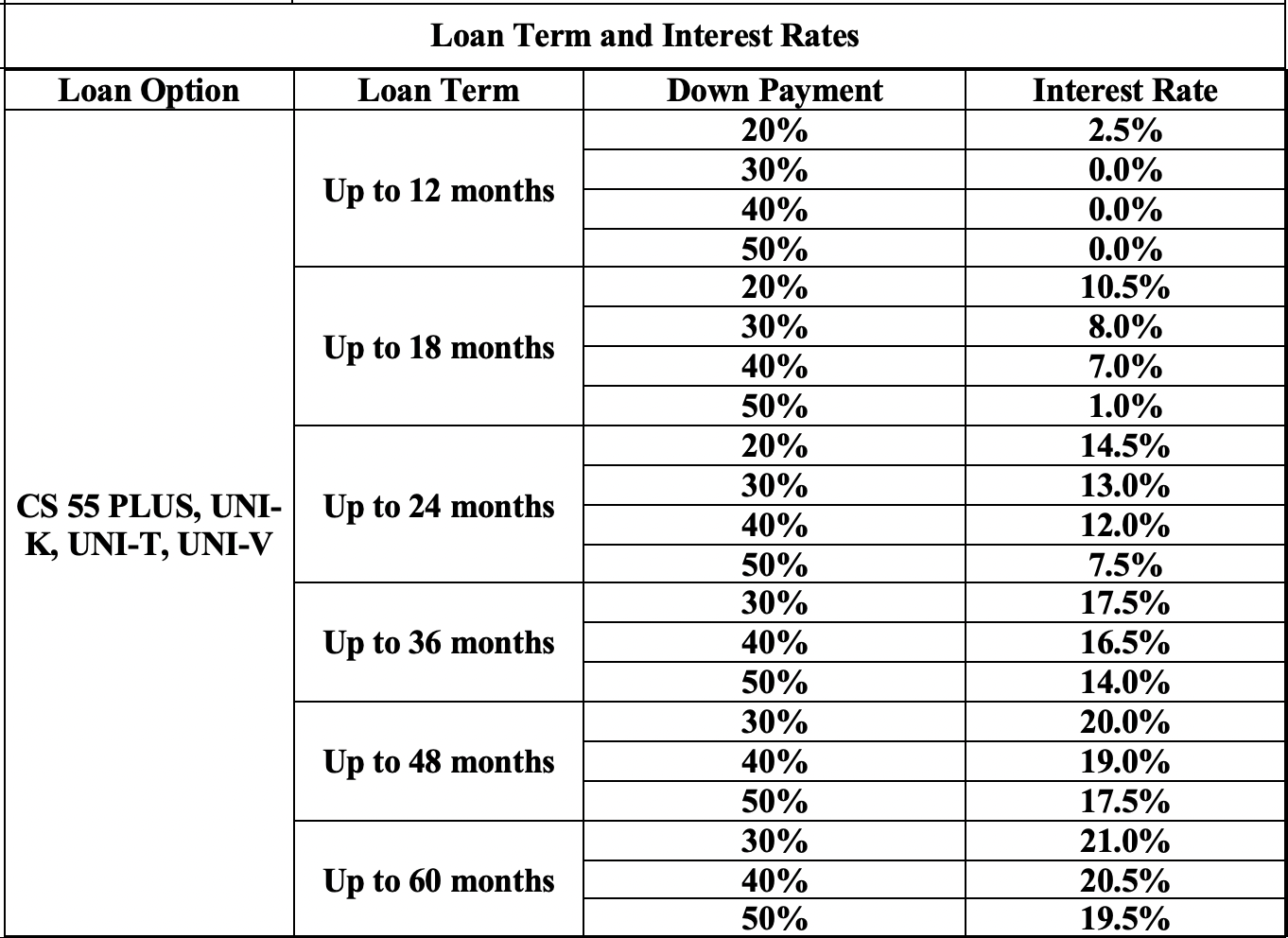

| Loan Term | Up to 60 (sixty) months. |

| Grace Period | Up to 3 (three) months. |

| Loan Currency | National currency (Uzbek soum). |

| Form of Disbursement | Funds are transferred directly to the dealer’s or seller’s account. |

| Interest on Overdue Payments | 33% |

| Interest Accrual | Interest is accrued daily at a fixed rate and repaid through annuity or differential payments in accordance with the approved schedule. |

| Principal and Interest Payment Period | Principal and interest are repaid monthly. |

| Main Client Eligibility Requirements | - The borrower must have a primary or secondary account with JSC “Garant bank”; - The borrower’s Statement of Financial Results (Form No. 2) must not show a loss for the latest reporting period (annual or quarterly), except for individual entrepreneurs and newly established (less than 6 months) legal entities; - - The borrower’s own working capital must not be negative (except for individual entrepreneurs and newly established legal entities within 6 months); - - No outstanding payments recorded under “Register No. 2” (overdue payments queue); - - No outstanding debt under enforcement proceedings initiated by the Bureau of Compulsory Enforcement. |

| Collateral Requirements | 1. Deposit funds; 2. Real estate; 3. Vehicles not older than five years; 4. The vehicle purchased with loan funds shall serve as collateral, and an insurance policy covering the risk of loan default shall be issued for any shortfall in collateral value. In this case, a temporary insurance policy against loan default shall be arranged until the delivery of the vehicle by the supplier and notarization of ownership documents. The total collateral value shall be at least 125% of the loan amount. - For related parties (affiliated with the Bank), the collateral coverage shall be at least 130%. |

List of Documents Required for Loan Application

1. Loan application and checklist explaining to the client the risks associated with the loan.

2. Incorporation documents of the borrower company (certificate of registration, charter, appointment order of the director, and copies of ID documents of founders, director, and accountant, if applicable).

3. Founders’ resolution or consent authorizing the company to obtain the loan, in accordance with the current legislation (except for individual entrepreneurs and private enterprises).

4. Borrower’s balance sheet and statement of financial results (submitted electronically to the relevant authority of the State Tax Service) for the latest reporting period (annual or quarterly), except for individual entrepreneurs and newly established legal entities.

5. Copy of the vehicle purchase and sale agreement

2. Incorporation documents of the borrower company (certificate of registration, charter, appointment order of the director, and copies of ID documents of founders, director, and accountant, if applicable).

3. Founders’ resolution or consent authorizing the company to obtain the loan, in accordance with the current legislation (except for individual entrepreneurs and private enterprises).

4. Borrower’s balance sheet and statement of financial results (submitted electronically to the relevant authority of the State Tax Service) for the latest reporting period (annual or quarterly), except for individual entrepreneurs and newly established legal entities.

5. Copy of the vehicle purchase and sale agreement

beta-версия