Updated: 04-11-2025

-

based on the cost of the projectloan amount

-

from 28%interest rate

-

up to 60 monthsloan term

| Parameter | Cost/Description |

| Segmentation of customers | Business entities |

| Requirements for a good credit history | • no existing overdue or other bad debts; • The score by the Loan Information and Analytical Center – above 200 points; • No existing loans categorized as "unsatisfactory", "doubtful" or "bad"; • The affiliated companies have no overdue accounts payable to "Garant Bank" JSC. |

| Current account of the customer | Primary or secondary |

| Form of the loan | Through a closed credit facility |

| Loan amount | Based on the cost of the project |

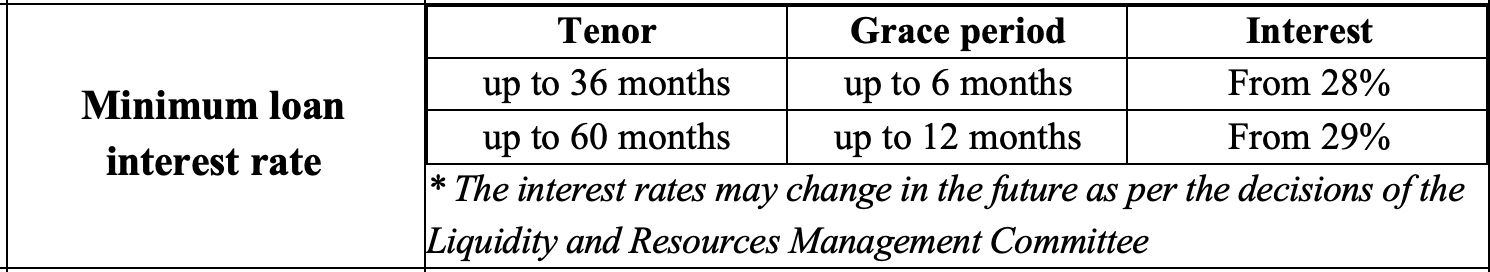

| Loan tenor | up to 60 months |

| Grace period for loans | up to 12 months |

| Purpose of the loan | Financing of investment projects, procurement of fixed assets (equipment, special equipment, residential and non-residential buildings and structures, etc.) |

| Currency of loan | National currency (UZS) |

| Source of financing | the Bank's equity and/or borrowed funds |

| Form of the loan | By transferring the money to the guarantor's account |

| Accrual of interest | Annuity or differential method |

| Period for payment of the principal and interest | Payment of the principal – monthly after completion of the grace period; Interest is to be paid monthly. |

| Effective interest rate | The difference between the cost of the resource involved and the interest rate on the loan |

| Collateral | At least 125% of the loan amount (for affiliated companies – 130%) |

| Forms of collateral | 1. Deposit; 2. Real estate; 3. Vehicles manufactured within last 5 years; 4. Other types of collateral that are not prohibited by the law and the applicable credit policy of the bank. |

| Main requirements for collateral | 1. For real estate: - valid rights to the land lot where the real estate is located on (not applicable to the apartments); 2. For guarantors (except for the cases when an additional collateral is obtained): - period of state registration shall be at least 12 months; - profit and loss statement (Form No. 2) shall not be in the red; - own working capital shall not be negative; - no arrears recorded in the register No. 2; - no monetary means payable due to litigation initiated by the Bureau of Enforcement; - amount of the guarantee provided shall not exceed 80 % of the total value of the guarantor's assets; - turnover of the guarantor company shall not be less than 50% of the amount of the guarantee within the last 12 months; 3. Temporary collateral can be furnished in the form of insurance until movable or immovable property acquired on credit is provided; in this case the liquid assets furnished are considered as collateral. |

beta-версия