Car loan «Komfort avto»

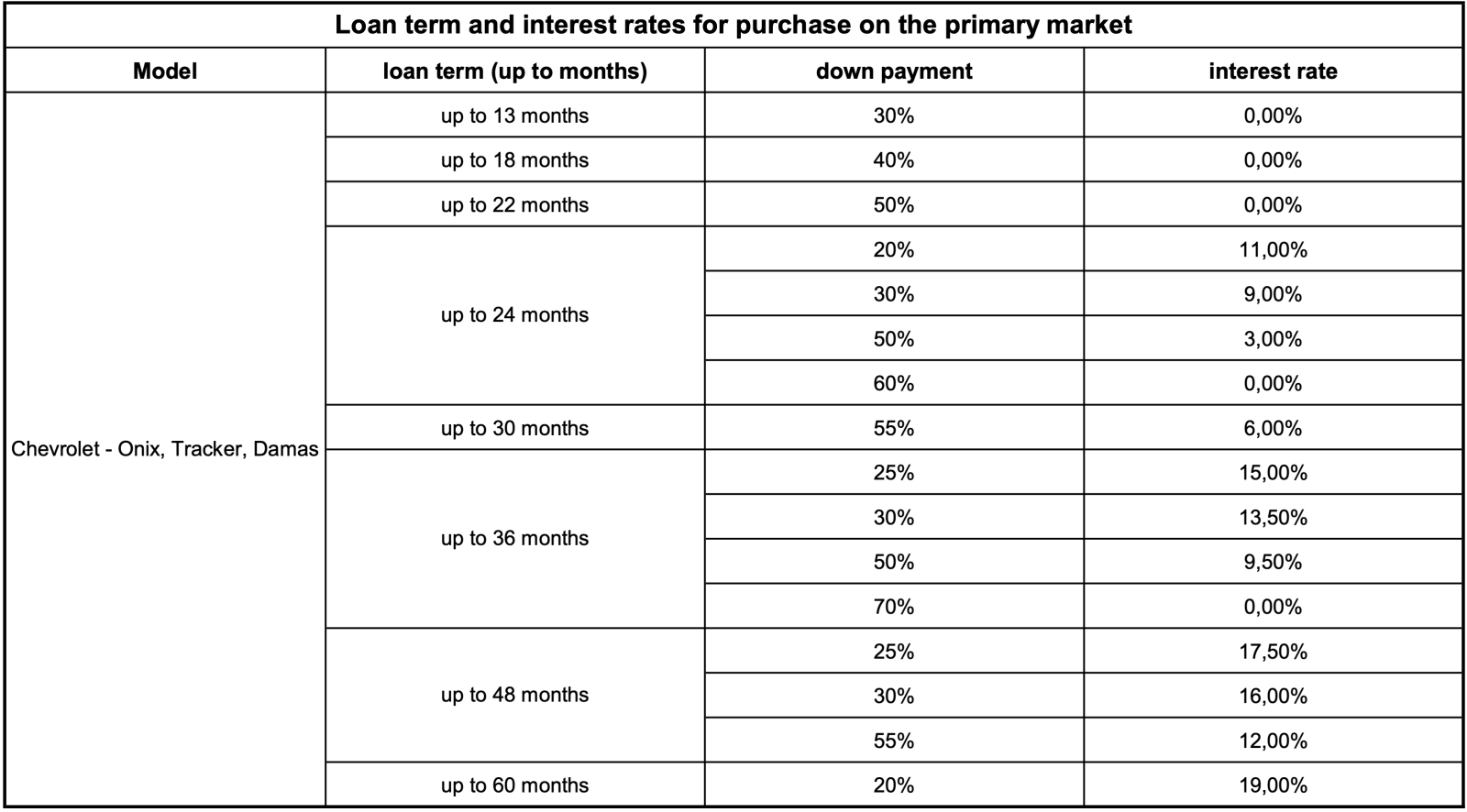

A 0% rate applies with a down payment of at least 30% for up to 13 months, 40% for up to 18 months, and 50% for up to 22 months

A 0% rate applies with a down payment of at least 30% for up to 13 months, 40% for up to 18 months, and 50% for up to 22 months

| Indicator | Value/Description |

| Loan Purpose | Car loan for the purchase of Chevrolet - Onix, Tracker, Damas cars manufactured by UzautoMotors on the primary market. |

| Customer segmentation | All types of legal entities and individual entrepreneurs |

| Requirements for a Credit History Report | 1. No overdue debt; 2. Good Credit History ( Scoring in the KIAC - above 200 points); 3. No outstanding loans overdue for more than 90 days in the last six months; 4. No existing loans classified as "unsatisfactory", "doubtful" and "hopeless". |

| Loan amount | up to 1,000,000,000 (one billion) soums |

| Loan term | up to 60 (sixty) months |

| Grace period for lending | up to 3 (three) months |

| Lending currency | National currency (Uzbek soum) |

| Interest accrual | In the form of annuity/differential |

| Repayment Period of principal and interest | Principal and interest payments are monthly |

Basic requirements for lending | - A primary or secondary account in the JSC Garant Bank system; - The Financial Performance Report (Form No. 2) shall not end with a loss for the last reporting period (annual or quarterly) (except for individual entrepreneurs, and newly (up to six months) established legal entities); - A net working capital shall not be negative (not required for individual entrepreneurs and newly (six months) established legal entities); - Good standing on card index file No. 2; - No debt that is in the process of enforcement proceedings. |

| Loan collateral | 1. Deposit facilities; 2. Real estate; 3. Vehicles manufactured no more than 5 years ago; 4. The vehicle purchased with a loan is secured by a pledge, and an insurance policy against the risk of non-repayment of the loan is issued for the remaining part of the pledge. In this case, the insurance policy is issued in case of risk of loan non-repayment until the car transfer to the supplier and its subsequent notarial certification. The pledge amount must be at least 125% of the loan amount. - Vehicles purchased on credit are accepted as collateral in an amount not exceeding 80% of the prime market cost. - For persons affiliated with the bank, the pledge for the loan is accepted in the amount of 130%. |